On August 25, 2021 the New York State Department of Taxation and Finance issued TSB-M-21(1)C, (1)I providing guidance on the Pass-Through Entity Tax (PTET). See prior article HERE. In that guidance it was advised that elections need to be made by March 15 of the tax year, ie. 2022 tax year is due on March 15, 2022. However, since the PTET is new in 2021, the election for 2021 must be made by October 15, 2021.

Some information to know before making your election:

- It is an annual election.

- It is irrevocable for each tax year it is made.

- Payment through an electronic bank account is required under this election.

- Filing of the PTET tax return will occur through the taxpayer’s NYS online account.

- A Tax professional cannot make this election for a taxpayer. Only an authorized person can.

Once you are ready to make your election please follow the below instructions:

1. Go to https://www.tax.ny.gov/online/ and log into your NYS Online Tax account. This username and password is your NY.gov ID username and password. You will have this ID if you file sales tax, employment or withholding taxes, or make online corporate tax payments. Additionally, the same log in is used for the Department of Labor and the NYS Health Insurance Marketplace.

(If you do not have a NYS ID, you can follow the video HERE by NYS Tax and Finance to create your ID.)

Once logged in Click on Services in the top left hand corner.

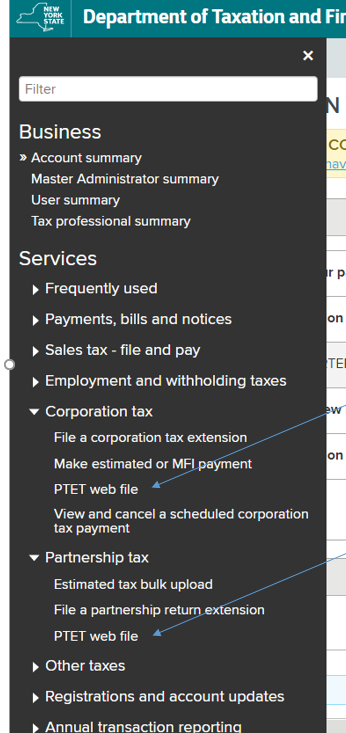

2. In the resulting menu, click on the triangle next to either Corporation Tax (S Corporations) or Partnership Tax and then PTET webfile.

(Remember only an authorized person can elect into the regime.)

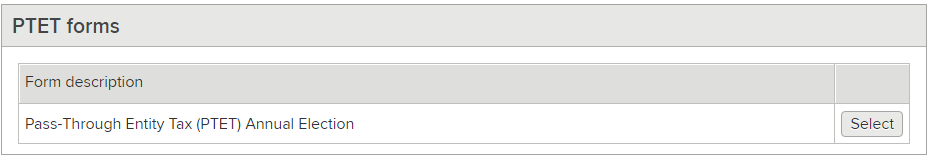

3. When in the PTET Web File – click on select in the PTET Forms next to the Annual Election.

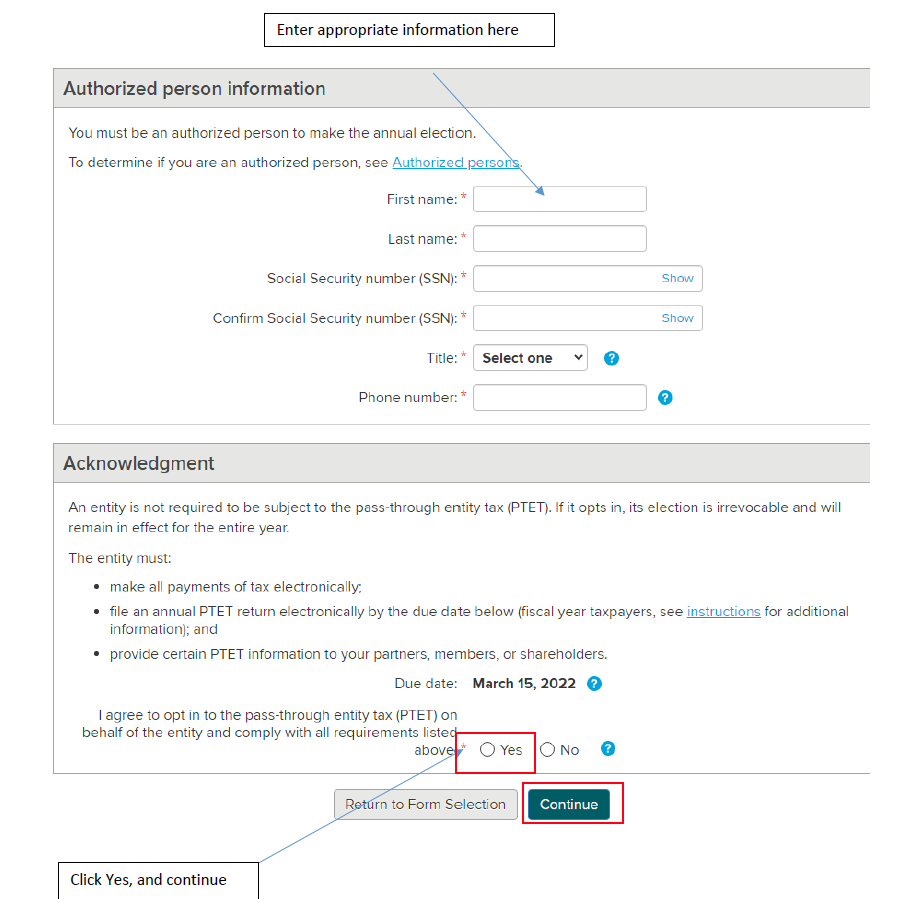

4. On the next Screen, you will be required to enter the name and Social Security number of the authorized person making the election and then actually make the election by clicking Yes and then Continue.

5. On the next screen, you will be asked to enter your physical and mailing address. Enter the appropriate information and then click submit to finalize your election.

6. Print your confirmation page and keep for your records. Send a copy to your accountant.

Please make sure your election for 2021 is completed no later than October 15, 2021. If you have any questions please contact your TBC advisor.